The Disney Visa card, offered by Chase, rewards card members with points for every dollar spent. However, with so many travel cards on the market, you’re likely wondering if the Chase Disney Visa card is really worth it or if you’d be better off with another card. In this Disney credit card review, we’ll cover all of the card perks and other considerations to help you decide if it’s right for you.

Table of contents

Covering the Disney Visa Card Perks

If you’re a mega Disney fan, the idea of a carrying a credit card adorned with Disney characters is probably right up your alley. And the fact that you get to change that card to a new design any time you want? Superb!

However, is that Mickey swiping privilege really worth it if you could be earning more with another card? To decide, let’s dig into the perks with this Disney Visa credit card review.

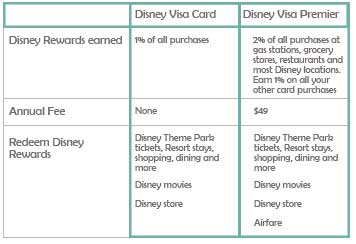

The Disney Visa card is offered in two varieties, The Disney Visa Card and the Disney Premier Visa Card, and both offer the same basic card swiping perks:

- SAVE 10% ON SHOPPING & DINING AT DISNEY PARKS: Receive 10% off select merchandise purchases of $50 or more at select locations and 10% off select dining locations most days at the Disneyland® and Walt Disney World® Resorts.

- CHARACTER EXPERIENCES:Disney Visa Cardmember-exclusive photo opportunities with Disney or Star Wars Characters, held in private locations at the Disneyland® and Walt Disney World® Resorts.

- SPECIAL VACATION FINANCING: 0% promo APR for 6 months on select Disney vacation packages from the date of purchase. After that, a variable APR of 15.99% will apply.

- DISNEY CRUISE LINE: Realize savings aboard the Disney Cruise Line when using your card to pay for select onboard purchases. Receive 10% off a Castaway Cay Getaway Package.

- Save 10% on select purchases at Disney store and shopDisney.com.

- Get access to exclusive Disney Visa Cardmember events at Disney store.

The primary difference between the two cards comes when adding up rewards as each earns at a different rate. The original Disney Visa card returns 1 percent in Disney rewards dollars on all purchases. Simply put, that means you’ll earn 1 Disney reward dollar for every $100 you charge to the card.

Disney reward dollars can then be redeemed for Disney items such as merchandise at the Disney store, Disney Broadway tickets or even purchases made at Disney parks, including restaurants and resort reservations. There is no annual fee associated with this card, so it isn’t a bad bet if you’re a frequent Disney shopper.

As a Connecticut-based travel agent with Mickey World Travel, Kathleen Hesketh can help you plan and book your Disney World vacation no matter where you live within the U.S.

Plan your vacation your way and receive as much or as little help as you want.

- Booking dining reservations, saving you the 6:00 am wake up call

- Custom itinerary suggestions

- Convenient payment plans

- Help with Genie+

- and more

Fill out the form to the right (below on mobile) for a no-obligation quote.

However, if you travel frequently and tend to put a lot of daily purchases on a credit card, the Disney Premier Visa card will offer more perks in the long run. The card returns the standard 1 percent reward for most purchases, but offers 2% in Disney reward dollars on purchases at gas stations, grocery stores, restaurants and most Disney locations. With the Premier card, you could earn $1.00 for every $50 you spend with these establishments.

The big drawback to this card is the $49 annual fee. While fees have become commonplace with many cards, it can be hard to justify when the regular Disney card is free to hold, so Chase and Disney got together to power this card with an additional perk.

In addition to using rewards points on Disney-related merchandise, shows and vacations, Disney Premier Visa cardholders can also use points toward airfare on most major carriers with none of the blackout dates associated with some other major credit cards. You simply book your airfare and then request that your Disney rewards dollars be issued back to you in a refund to cover the cost of the fare.

Disney Credit Card Review: Which Card Is Best?

To decide which Disney Visa card would best fit your needs, spend some time reviewing your purchasing habits and how much you typically charge in a year. With a 1% return on purchases, you’ll need to spend $4900 annually just to cover the annual fee on the Disney Premier card. If your card spending is typically less, opt for the Disney Visa card with no annual fee, unless you routinely use your card for purchases in the 2 percent category, namely gas, grocery store purchases and restaurants. The Premier card’s annual fee would be covered by $2450 worth of purchases at locations that offer a 2 percent reward in Disney dollars.

While you can easily use the Disney Visa card with no annual fee to rack up points on purchases, it might not be worth your while. Let’s use a little real world chemistry to understand the magic of the Disney Visa Card.

If you plan to purchase a single day theme park ticket at Disney World, you could easily spend $100 or more. Before you can use your Disney rewards dollars to cover that purchase, you’d first have to charge $1000 on your credit card, assuming you’re holding the Disney Visa card with no annual fee.

If you’re planning a trip to Disney World on a budget, you might be thinking that the Disney Visa rewards card could help you offset some of your costs. However, you don’t have to punch numbers into your calculator for long to realize it takes some serious spending to earn enough rewards dollars to make a dent in a Disney World vacation at today’s prices. However, if you use it for everyday purchases, rewards dollars will add up over time.

Before you sink your daily spending into a Disney Visa card, take a look at several of the other cash back or rewards cards on the market. You might find one that will help you afford that Disney vacation a little faster while also meshing better with your spending habits. For example, the Citi Double Cash card offers a 2 percent reward on all purchases with no annual fee. Best of all, you can use your cash back anyway you like, such as covering the costs associated with a Disney World vacation.

How Do I Use My Disney Rewards?

Cashing out rewards points with the Disney credit card is simple. Just log into your account and click the rewards panel. From there, you’ll be offered two options.

You can take your rewards in cash by applying them to a Disney Rewards Redemption card. This is similar to a plastic gift card that can be used at most Disney locations, including parks and the Disney Store. The card will be mailed to you free of charge, but could take several days to arrive.

If you’re loading up the card to use on your Disney World vacation, be sure to place your Disney Rewards Redemption card order a few weeks before you leave for your trip. The card is reloadable, so you can always add more rewards dollars if you accrue additional earnings before your vacation begins.

You can also apply your points as a refund for airline travel. Just be sure to charge your airfare purchase to your card before seeking a statement credit.

The Bottom Line: Is the Disney Credit Card Worth It?

Since no Disney Visa Credit card review is really complete without some first hand experience, I’ll let you in on a few of the things I’ve discovered over the years.

As I previously mentioned, I’ve used the Disney credit card from its first inception, and for years, this was our primary mode for charging. Since we typically visit Disney World every couple of years, I’d managed to head off on our trips with a couple hundred dollars in rewards, by raking in 1 point for every $100 dollars spent. While it by no means covered the cost of a trip, it did help to offset some of our dining expenses.

However, getting to this point did take a concerted effort. I’d use the card to cover larger expenses, such as medical bills, insurance and sometimes even taxes (when extra fees did not apply). I’d pary nearly every bill that I could with the card as well to maximize spending with a 1% return.

Then came a new plethora of rewards cards. Some offered cash back, while others, like the Chase Sapphire Preferred, offered me 2 percent on travel purchases, with bonus categories that often offered 3-5 percent. Since we were now traveling to other destinations, it made more sense to use a card that offered me points that could be used on a far range of travel experiences, and quite frankly, handed out a bigger bounty in the way of card perks.

As a result, I’ve begun using the Disney Visa Card only for category purchases that net a 2% return, such as at gas stations, as well as any purchases made through Disney, such as hotel reservations. This has allowed me to earn a little extra pocket change toward upcoming Disney trips, while earning more on the bulk of my purchases for other travel experiences.

So, deciding wheter the Disney Visa card is really worth it, comes down to one simple factor: How do you use your credit card? If the majority of your purchases are made at restaurants, gas stations, grocery stores, the Disney Store or any of the Disney parks, the original Disney Visa with no annual fee could be a good card to have in your wallet. You’ll earn 2 percent toward your next Disney trip on most of your purchases and 1 percent from everything else.

However, if you tend to charge more in other categories, you are better off seeking a card with a wider set of perks. Remember, the Disney credit card most benefits the repeat Disney World traveler, so if you’re making your first and only trip, find a card that offers more in travel rewards or cash back, so you can use your card member rewards toward a broader range of experiences.

Last, with a $49 a year fee, the Disney Premier card is rarely worth it unless you make most of your purchases in the 2% rewards category and plan to use the points toward airfare purchases as welll as Disney vacations. Even then, you’ll find many other rewards cards on the market that add up airline benefits faster, making this card a really tough sell.

Disney Card Review Quick Take

If you’re a Disney uber fan and take regular vacations to Disney parks or make other Disney related purchases, the Disney Visa card can give your budget a little boost via Disney rewards dollars. However, if you only plan to visit the parks once on an upcoming vacation and rarely make other Disney purchases, there are much better cards to carry in your wallet. Many offer far better sign up bonuses as well, helping you reach cash back or travel savings much faster.

So what’s the bottom line? The Disney Visa card is best for those who make yearly visits to the park and frequently use their card for everyday purchases. Also, don’t forget, if you carry a balance on your credit cards, the penalties you are accruing in interest and fees will likely wipe out any rewards you’ll be earning by using the Disney Visa card.